Anti-bribery and corruption

risk assessments

Independent, evidence-based ABC risk assessments that enable organisations to identify, prioritise and address bribery and corruption risks across global operations, in line with international regulatory expectations.

Contact us

Why bribery and corruption risk assessments are essential

As enforcement of anti-bribery laws continues to intensify, regulators increasingly require businesses to demonstrate their understanding of any actual or potential corruption risks within their business operations. An effective anti-bribery and corruption (ABC) risk assessment and due diligence process is now a critical component of demonstrating adequate procedures under the UK Bribery Act, France’s Sapin II and the US Foreign Corrupt Practices Act (FCPA) It ensures risks are correctly identified, addressed and mapped across the business and is increasingly regarded as the first step in the development of an effective anti-corruption programme.

When should an organisation conduct an ABC risk assessment?

Anti-bribery and corruption risk assessments should be carried out periodically and especially in response to any significant developments that could increase a company’s exposure to the risk of bribery and corruption such as changes to the nature or scope of the business, or to the regulatory environment where it operates.

The most common reasons for conducting an ABC risk assessment include:

Aquisitions, restructuring or market expansion

Operating in high-risk jurisdictions or sectors

Preparation for regulatory scrutiny or audits

Compliance programme development or review

Compliance programme development, review or monitoring

Our methodology

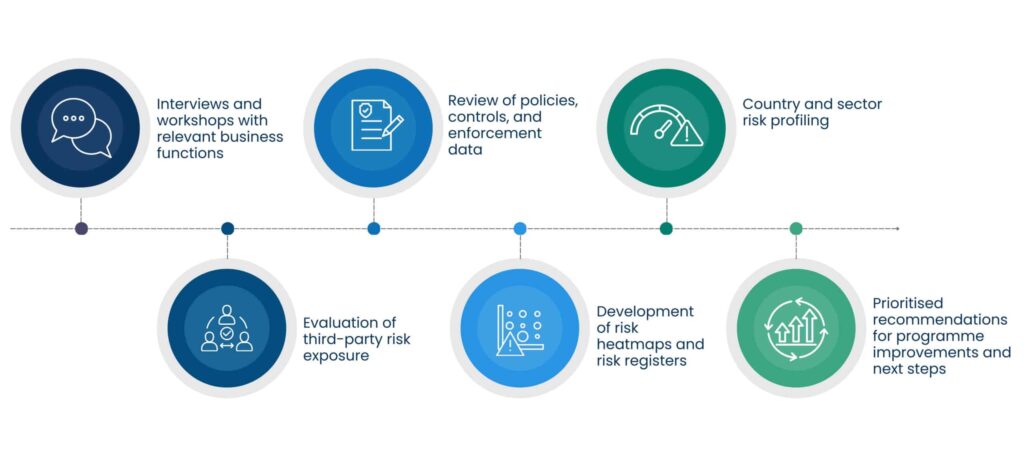

GoodCorporation has devised a robust risk assessment and due diligence process that can be tailored to the needs of individual organisations, combining regulatory alignment with practical business insight. The insights gathered feed directly into an organisation’s compliance programme, helping design controls that are proportionate to the nature and scale of bribery risks.

Drawing on The GoodCorporation Anti-Corruption Framework, incorporating internationally recognised best practice, our risk mapping exercises align with the requirements of prosecuting authorities such as the UK’s Serious Fraud Office and France’s Agence Français Anticorruption. Our experienced team can help identify risks by country, by sector and by the nature of the operation.

Our methodology includes:

Why choose GoodCorporation?

GoodCorporation facilitates rigorous and thorough anti-bribery risk assessments, helping companies to focus on the granular details of the corruption risks specific to the nature and location of their business operations. This enables companies to develop adequate controls to prevent corruption that are proportionate to the nature and scale of the bribery risks.

Trusted by FTSE 100 companies, multilateral institutions and leading corporates in over 40 jurisdictions, we bring more than two decades of experience conducting ABC global risk assessments, helping businesses pass regulatory scrutiny and strengthen compliance culture. Our independent, data-driven approach and deep sector expertise enable us to deliver objective insights that help organisations design and improve their anti-corruption programmes and meet their regulatory obligations.

Key benefits

A thorough anti-bribery and corruption risk assessment provides organisations with a clear understanding of their exposure to corruption risks and how this can be mitigated. Key benefits include:

- Demonstration of compliance with international anti-bribery laws

- Provision of board-level assurance with robust risk data

- Strengthening of ABC programmes by closing control gaps

- Enabling efficient allocation of compliance resources

Listen to the podcast

Our guide to implementing an effective anti-corruption risk assessment

Related news and insights

Frequently asked questions

An ABC risk assessment is a structured process used to identify, evaluate, and prioritise corruption risks within an organisation. It typically includes reviewing policies and procedures, conducting stakeholder interviews, assessing jurisdictional and sector risk, and producing a clear risk profile with recommended mitigation actions.

An anti-bribery and corruption (ABC) risk assessment helps organisations understand where and how bribery and corruption risks may arise across their operations, business relationships, and supply chains. By systematically identifying these risks, companies can evaluate their exposure and put in place proportionate mitigation controls to reduce the likelihood of misconduct.

While an anti-bribery and corruption (ABC) risk assessment is not always a statutory requirement, regulators strongly expect organisations to carry out regular, risk-based assessments as part of their compliance obligations. Conducting an ABC risk assessment helps businesses align with anti-bribery laws such as the UK Bribery Act and the US Foreign Corrupt Practices Act (FCPA), demonstrating that potential bribery and corruption risks have been identified and proportionate controls put in place.

Even when not legally mandated, a structured ABC risk assessment is considered best practice for maintaining an effective anti-bribery programme. It supports compliance monitoring, informs policies and training, and provides evidence to regulators, auditors, and stakeholders that the organisation is proactively managing bribery risks.

It is also increasingly required by investors, helping to boost confidence and support access to capital.

Organisations should conduct anti-bribery and corruption (ABC) risk assessments on a regular basis to ensure their compliance programmes remain effective and aligned with evolving risks. Best practice recommends reviewing risk assessments every 2–3 years. However, they should be updated promptly in response to significant organisational changes, such as mergers and acquisitions, entering new markets, or shifts in regulatory expectations and changes to industry-specific risks.

Regular ABC risk assessments help companies identify bribery and corruption risks, adjust mitigation controls, and maintain a proactive approach to compliance. By embedding periodic reviews into governance processes, organisations can demonstrate to regulators, auditors, and stakeholders that they are actively managing bribery risks and maintaining a robust anti-bribery programme.

The length of an anti-bribery and corruption (ABC) risk assessment depends on the size and complexity of the organisation, the scope of operations, and the level of stakeholder engagement required. Larger or multinational organisations may require more time, with smaller or more focused assessments typically taking less.

An ABC risk assessment requires support and engagement from across the business to ensure it is accurate and comprehensive. Organisations are expected to provide time from key stakeholders for interviews and workshops, access to relevant documentation and internal records, and data on business operations, third parties and compliance activities. Participation in risk workshops is also important to help evaluate and prioritise risks.

An ABC risk assessment provides a set of clear, practical outputs that can be used both internally and with external stakeholders. These include a detailed report mapping bribery and corruption risks across the organisation, a risk register and heatmap categorising risks by impact and likelihood, benchmarking of existing policies and controls against GoodCorporation’s frameworks and tailored recommendations to strengthen anti-corruption procedures.