Register for our upcoming webinar 'Preparing for the CSDDD'

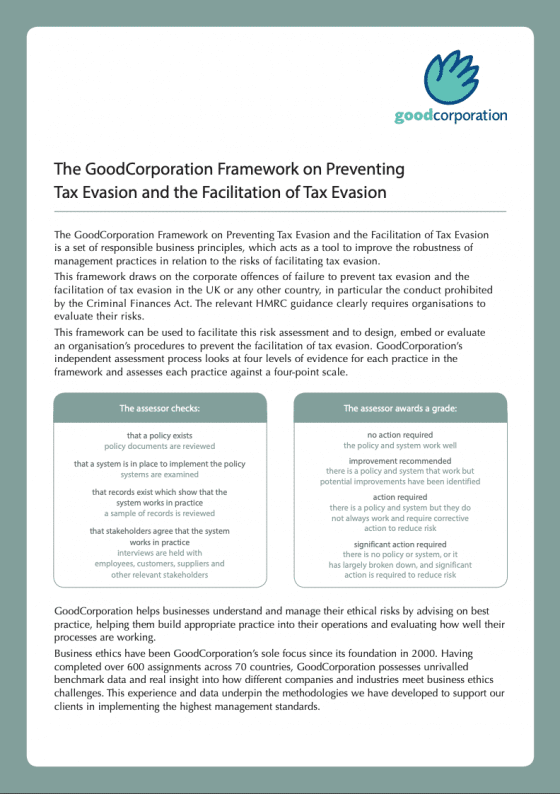

Tax evasion framework

GoodCorporation's four-page Framework on Preventing Tax Evasion and the Facilitation of Tax Evasion comprises a set of responsible business principles that can be used as a tool to improve the robustness of management practices in relation to the risks of facilitating tax evasion.

Areas covered by the framework

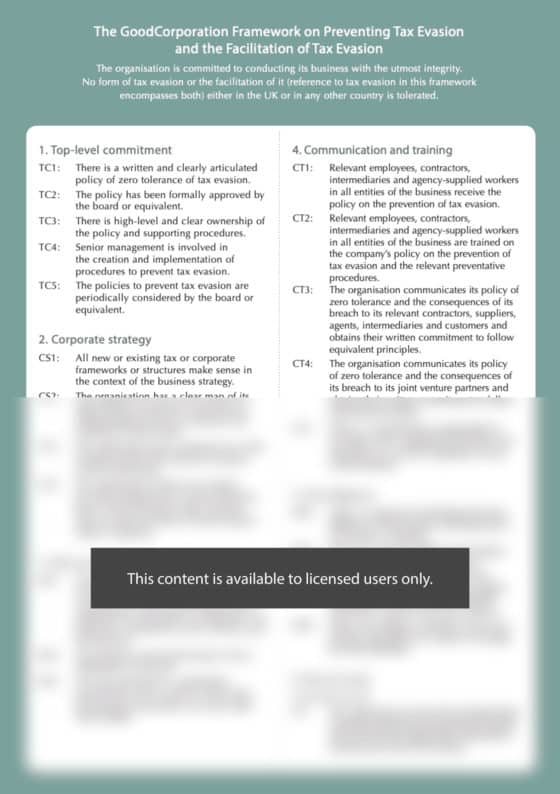

- Top-level commitment: senior management ensures that there is a zero-tolerance of tax evasion with effective policies and procedures in place to prevent it occurring.

- Corporate strategy: the organisation understands its tax liabilities in all its legal entities and has frameworks and structures in place to meet these obligations.

- Risk assessment: the organsiation ensures that all risks of tax evasion are proactively assessed and mitigated.

- Communication and training: the organisation can evidence that employees and relevant stakeholders are trained on and abide by its anti-tax evasion policies and procedures.

- Due diligence: there are clear processes for deciding on and conducting effective due diligence.

- Key tax areas: the organisation understands the business functions that trigger tax payments and has effective procedures in place to mitigate any risk of tax evasion.

- Transparency: the organisation can demonstate a commitment to tax transparency.

- Compliance and monitoring: there are effective monitoring processes in place to ensure that policies and procedures are properly implemented.

Explore our frameworks

Browse our frameworks below and download your copy