Anti-corruption due diligence support

Protect your organisation from third-party bribery risks

Third-party relationships present a significant corruption risk for global businesses. Almost half of enforcement actions under the OECD Anti-Bribery Convention involve agents, distributors, or intermediaries rather than employees. Even experienced compliance teams can struggle to apply third-party due diligence consistently and effectively.

GoodCorporation helps organisations manage this through structured third-party due diligence and bribery risk assessment services. Our work supports compliance with the UK Bribery Act and EU anti-corruption requirements, strengthening supplier screening, and helping companies maintain a defensible position with regulators. Services can be delivered as a targeted review or integrated with wider initiatives such as anti-bribery training and compliance audits, providing practical outcomes and supporting the development of a robust anti-corruption programme.

Effective anti-corruption due diligence design for stronger, risk-based compliance

GoodCorporation designs and implements anti-corruption due diligence that is both proportionate to an organisation’s level of risk and workable in practice. Our services are tailored to an organisation’s operational structure and specific risk profile and can be delivered as advisory input or a fully managed service.

Our comprehensive methodology has been developed in line with the UK Bribery Act and international best practice guidelines and includes:

Reviewing existing due diligence processes and identifying strengths and gaps

Benchmarking procedures against sector peers and best practices

Conducting risk assessments of third-party relationships and supply chains

Designing or refining due diligence frameworks to ensure proportional, effective controls

Supporting the selection, configuration and implementation of due diligence software

Developing and delivering training to embed the new system

What is anti-corruption due diligence and why does it matter for compliance success?

Every organisation rely on third parties to operate effectively, be they agents, distributors, suppliers, consultants and one-off partners. But these relationships also create a significant exposure to corruption and reputational risk. For global businesses, this network can run into the thousands, making it challenging to apply a consistent, proportionate and well-documented due diligence process.

At the same time, legislation such as the UK Bribery Act and US FCPA, along with OECD and EU requirements, makes it clear that companies are expected to understand who they are working with and whether those relationships might expose them to the risk of corruption.

Anti-corruption due diligence provides a structured and evidence-based process to assess that risk. It involves understanding who owns and runs the third party, how it operates, what controls it has in place and whether anything in its history raises concern. Applied properly, it moves beyond a tick-box one off exercise to become a critical tool for managing and embedding integrity across supply chains and commercial networks.

How can organisations get this right?

No organisation can apply the same level of scrutiny to every third party, nor is that necessary. A proportional and risk-based approach ensures that resources are focused on areas of greatest exposure. High-risk relationships may require deeper investigation and ongoing monitoring, whereas lower-risk partners can be cleared with lighter checks provided the rationale is clear and documented.

Applied consistently, due diligence becomes a central element of the “adequate procedures” expected under the UK Bribery Act and other international frameworks. More importantly, it helps organisations avoid being caught out by the actions of those acting on their behalf.

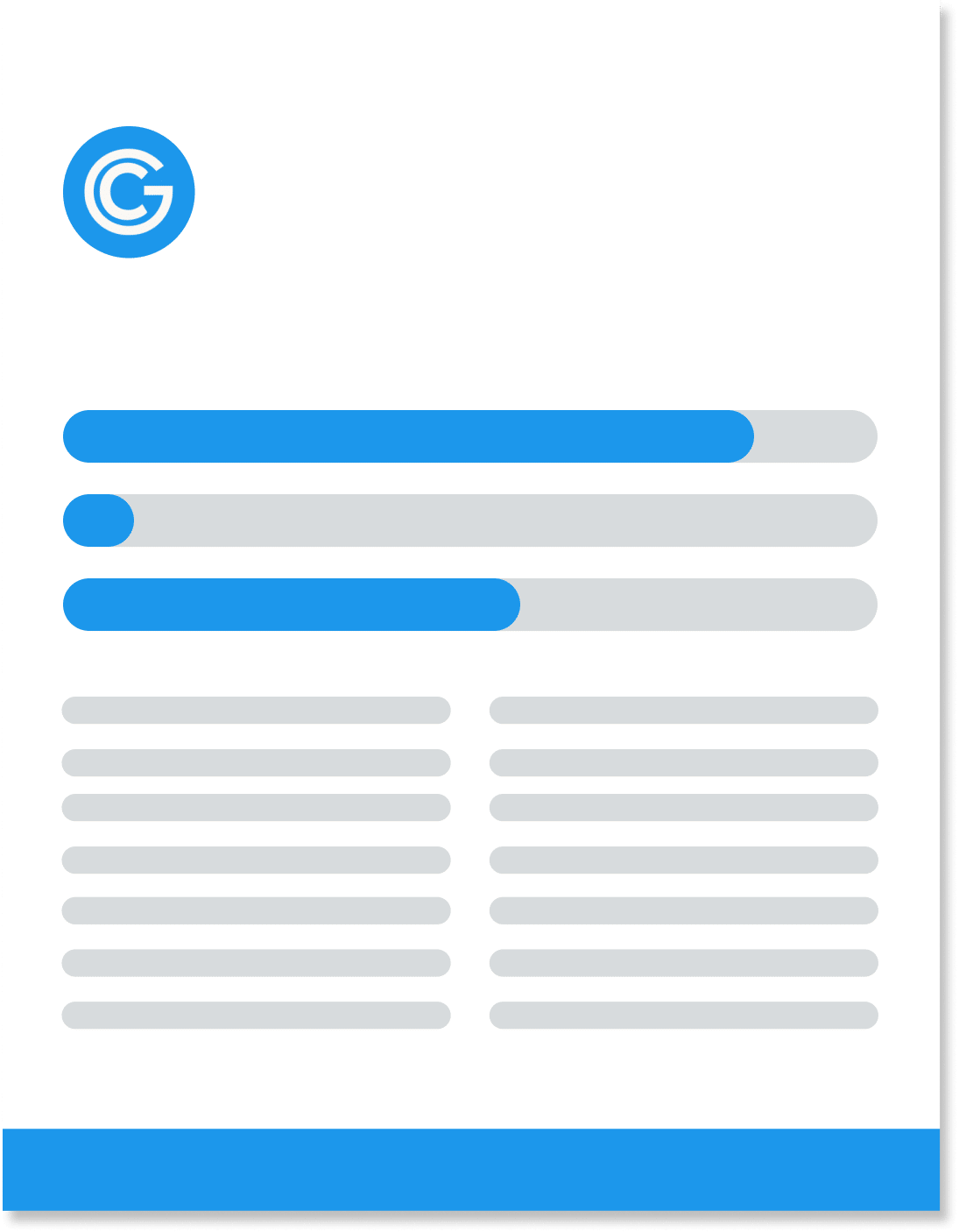

Contact UsGoodCorporation’s three-step process for anti-corruption due diligence

GoodCorporation helps organisations implement effective third-party due diligence through a structured three-step process. Each step is designed to ensure that due diligence is proportionate, risk-based, and aligned with regulatory expectations:

Identify high-risk third parties

- Categorise suppliers, agents and intermediaries according to risk exposure

- Define due diligence requirements for high, medium and low-risk relationships

- Focus resources on the highest-risk areas

Gather reliable information

- Issue tailored questionnaires covering ownership, governance, policies, and corruption controls

- Review, verify and cross-check responses to identify potential red flags

- Ensure robust and reliable data for risk assessment

Mitigate areas of concern

- Categorise suppliers, agents and intermediaries according to risk exposure

- Define due diligence requirements for high, medium and low-risk relationships

- Focus resources on the highest-risk areas

Additional support as required

Beyond the three steps, GoodCorporation can provide advisory input such as process review, benchmarking, risk assessments, and training, all tailored to an organisation’s risk profile. Services can be delivered as advisory support or a fully managed programme.

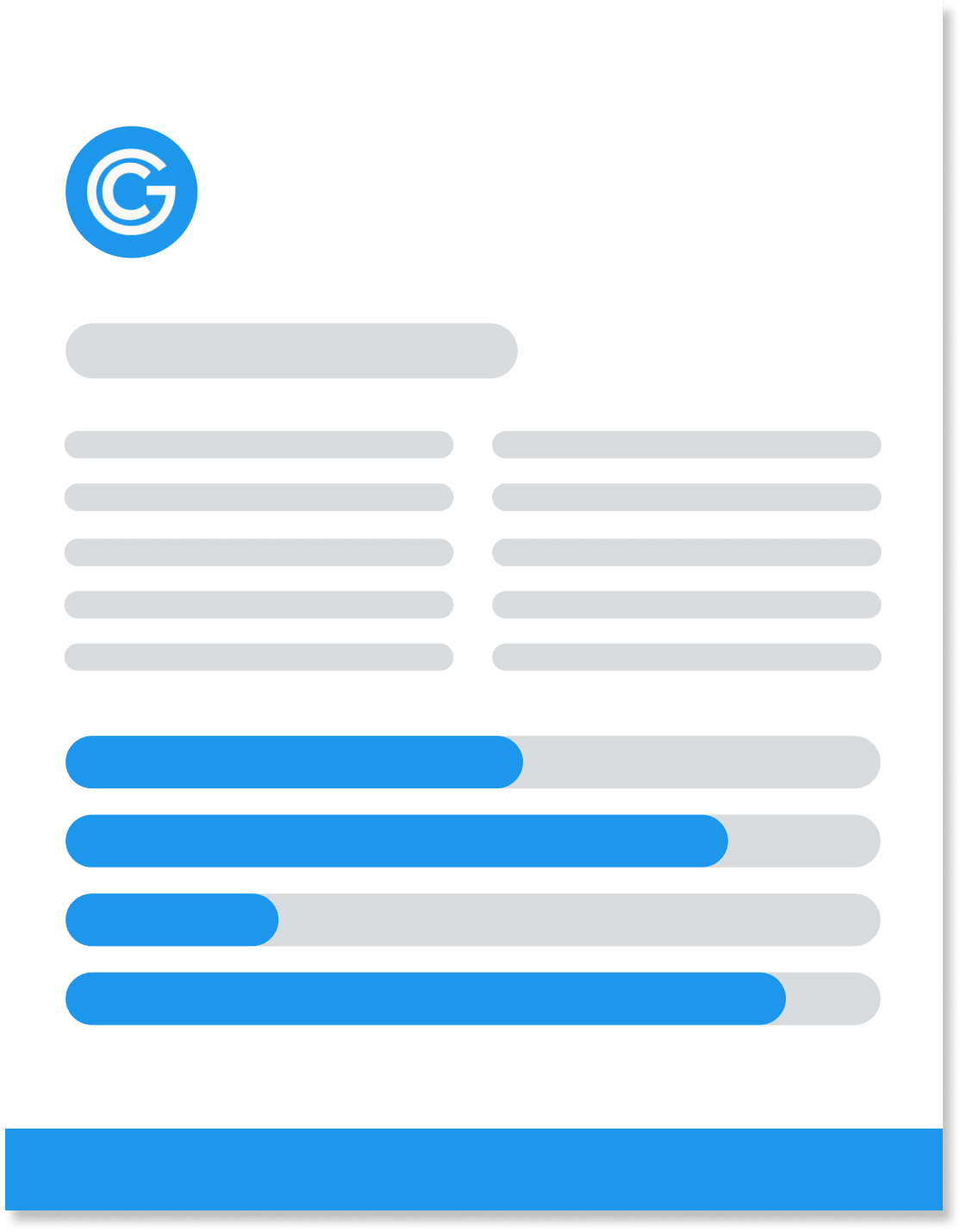

The struggle to

implement effective

anti-corruption due diligence

GoodCorporation’s latest research into anti-corruption due diligence and wider anti-corruption procedures highlights the challenges organisations face in managing third-party risk. Even where policies exist, consistently applying due diligence across suppliers, agents and intermediaries remains one of the most difficult areas of anti-corruption compliance. The insights below show where organisations are succeeding and where gaps remain, helping inform a structured, risk-based approach to managing corruption risk.

- Almost 70% of procedures met our adequacy criteria

Policies are often well established, but having a framework on paper does not always ensure effective implementation. - Over 50% of anti-corruption due diligence controls tested were too weak

Organisations frequently struggle to decide which third parties require checks and how to assess their ethical practices. - Third parties remain the highest-risk area

Businesses are more vulnerable to corruption through agents, intermediaries and suppliers than in any other part of their operations. - A clear gap exists between top and bottom performers

Companies successfully implementing anti-corruption controls significantly outperform those that are not. - Anti-corruption due diligence is the hardest area to get right

63% of controls assessed were found inadequate.

What this means for organisations

These findings highlight the importance of a structured, risk-based approach to anti-corruption due diligence. GoodCorporation works with organisations to define clear criteria, implement practical screening processes, and set expectations for escalation where concerns arise, ensuring that due diligence is applied consistently across all third parties.

Download the white paper for free to explore the full findings and practical guidance for improving anti-corruption due diligence.

Related news and insights

GoodCorporation were more thorough than we could have been. They really cared about getting the information we needed to have assurances about our third parties.

GoodCorporation due diligence client

Frequently asked questions

A: Anti-corruption due diligence is the systematic evaluation of third parties, such as agents, distributors and suppliers, to identify, evaluate and mitigate bribery and corruption risk. It is required whenever an organisation engages third parties that could expose it to compliance risk under legislation such as the UK Bribery Act or EU anti-corruption standards, or equivalent international standards.

Our services provide a risk-based assessment of third parties, including tailored questionnaires, verification, mitigation of red flags, software setup, and training. All elements are customised to the organisation’s risk profile and operational needs.

GoodCorporation’s due diligence approach aligns with UK Bribery Act and EU guidance, helping organisations maintain adequate procedures, demonstrate responsible business practices, and manage third-party risk effectively.